Have you ever taken out a payday mortgage previously? If that’s the case, you’re most likely questioning how lengthy it is going to take earlier than you pay again the mortgage — and the way a lot curiosity you’ll find yourself paying. In the case of planning your finances or getting ready on your future, lenders equivalent to Conway Inexperienced stress that it’s essential to know this details about payday mortgage calcs earlier than it’s too late.

The article supplies details about payday loans and payday mortgage calculators that assist reply these considerations!

What’s a payday mortgage?

A payday mortgage is a short-term, unsecured mortgage that may be taken out in money. The borrower should pay again the mortgage instantly, sometimes inside two weeks. They’re usually costly and have excessive rates of interest.

One solution to calculate how lengthy it is going to take you to repay a payday mortgage is to make use of a payday mortgage calculator. These instruments enable debtors to see how a lot debt they’ll owe on a specific date and the way usually they might want to pay again the cash. They’ll additionally estimate what number of weeks or months it is going to take them to repay your entire mortgage.

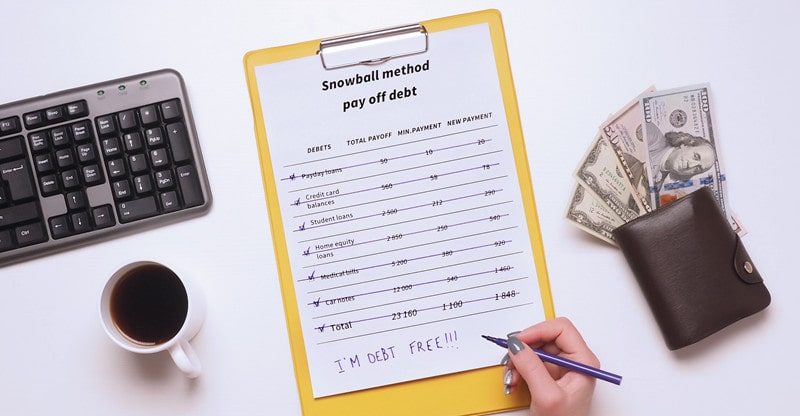

What are the alternative ways to repay your payday mortgage?

There are a selection of reimbursement choices for payday loans, every with its personal benefits and downsides. Here’s a rundown of the completely different strategies.

1. Compensation plans

You’ll be able to select from a spread of reimbursement plans, which helps you to repay your mortgage over a sure time period. The commonest plans allow you to repay your mortgage in full inside six months, however there are additionally plans that allow you to pay down the principal over an extended time period. The size of the plan relies on how a lot cash you borrow and the way lengthy it takes you to repay it.

2. Debt consolidation

When you have multiple payday mortgage excellent, consolidating them into one mortgage will help scale back your general debt burden. Consolidation lenders will handle all of the paperwork for you, so all you need to do is pay again the consolidated mortgage.

There are some essential issues to bear in mind when consolidating your debt: be sure you evaluate rates of interest and charges earlier than signing up, and make sure you perceive the phrases and circumstances of the contract.

3. Compensation plans with extensions

If paying off your payday mortgage in full inside six months isn’t possible since you’re busy or produce other commitments, it’s value drawing a reimbursement plan with extensions.

Conclusion

There isn’t any one reply to this query — it relies on numerous various factors, together with your present monetary scenario and the sum of money you’re attempting to pay again. Nonetheless, utilizing a dependable payday mortgage calculator gives you an concept of how lengthy it would take you to repay your mortgage primarily based in your revenue and different related data.

So in the event you’re searching for a tough estimate or need to monitor your progress over time, a payday mortgage calculator may be useful.