Cash worries are one of the vital frequent causes of stress amongst adults. The pandemic has induced many people to consider tightening our belts. On this information, we’ll discover some easy methods you possibly can minimize prices and turn into a savvy saver.

Making a family finances

Step one to take when embarking upon a financial savings drive is to create a family finances. Earlier than you begin, take a couple of minutes to undergo latest statements and analyze your transactions.

Many people discover it troublesome to maintain monitor of spending and we find yourself making funds that we’d not even pay attention to. You probably have a health club membership you by no means use otherwise you signed up for a freebie from a subscription service, for instance, now could be the time to chop out pointless bills and cancel companies that you just don’t need or want.

When you’ve gotten your statements in entrance of you, begin drawing up your finances. Use three columns to notice down your earnings, your common outgoings and one-off bills that you must pay that individual month.

Keep in mind to incorporate all the pieces in your finances and to be as correct as potential. The place you employ estimates, spherical up quite than down. Upon getting all of the figures in entrance of you, you possibly can calculate the distinction between your earnings and your outgoings.

Use your finances to find out whether or not it can save you cash or repay money owed and to set spending limits. Take a more in-depth take a look at the place your cash goes every month and attempt to make financial savings. Should you’re shocked by the quantity you’re spending on takeouts or consuming out, for instance, set your self a finances for the following month. Should you’re spending an excessive amount of on the grocery retailer, set up a brand new restrict and hold monitor of the whole as you navigate the aisles.

Everyone knows that life could be unpredictable so it’s helpful to replace your finances all through the month, adjusting figures and including any sudden windfalls or bills.

Maintaining monitor of spending

We reside in a world the place we are able to purchase issues with out utilizing a card or taking cash or notes out of a pockets, and many people have a number of direct debit funds arrange. It may be onerous to hold monitor of the place your cash goes once you store on-line, you pay payments robotically with out seeing statements or writing cheques and also you faucet a card or a smartphone to make a fee in a matter of seconds.

Should you are inclined to lose sight of the place you’re financially, it’s a wonderful thought to make the most of on-line banking. Examine your steadiness every day, check out latest transactions and use apps to watch spending. Should you use bank cards, it’s notably helpful to examine your balances regularly and to be sure you make common funds.

Managing debt

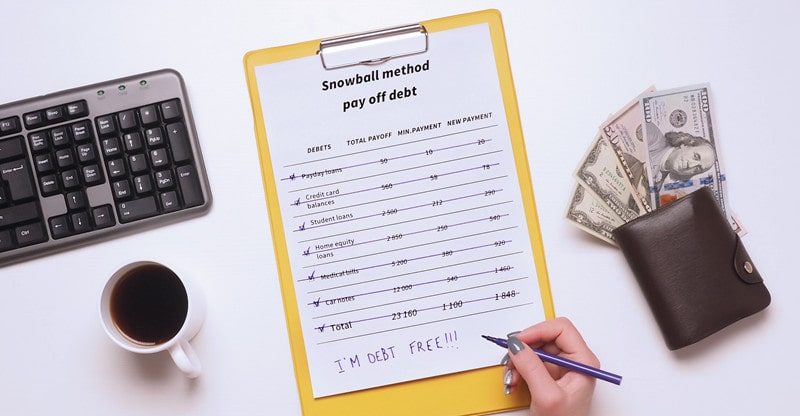

Paying off money owed can eat into your month-to-month earnings, notably should you use bank cards or you’re paying off a high-interest mortgage. If you’re attempting to scale back your debt, attempt to handle your cash to be able to decrease curiosity funds and keep away from costs and penalties. Search for alternatives to avoid wasting by transferring to 0% bank cards, attempt to keep away from placing something on playing cards until you completely need to or you possibly can pay it off swiftly, and contemplate all of your choices earlier than borrowing cash.

Should you can repay money owed rapidly, you’ll scale back your complete debt in addition to reducing the danger of incurring extra curiosity costs. Many individuals are in debt, which is beneath management and they’re able to sustain with mortgage and mortgage funds.

The difficulty begins when you’ve gotten issues overlaying funds otherwise you begin to add to your debt with out having the ability to repay present money owed. If you end up on this scenario otherwise you’re apprehensive about cash, there may be assist obtainable. You’ll be able to contact charities that supply recommendation totally free and there are additionally sources on-line.

Evaluating costs

One of many quickest, best methods to decrease family payments is to match costs. Because of the Web, it’s now potential to match provides and offers on all the pieces from garments and electrical home equipment to insurance coverage and cellphone contracts in a matter of seconds. You should utilize search engines like google and comparability websites to avoid wasting.

Earlier than you place orders for merchandise, renew insurance policies or select an power supplier, enter your particulars or the title of a product and look via the outcomes. You is perhaps stunned at how a lot you might save just by selecting one retailer over one other or switching to a special insurance coverage or power firm.

One necessary consideration to remember when you find yourself attempting to avoid wasting is contract size. Client champion Anna Richardson advises in opposition to taking out lengthy contracts that tie you right into a plan. You probably have an insurance coverage coverage or a telephone contract that runs for not less than a 12 months, you might be lacking out on higher offers on short-term, versatile contracts, and there’s a danger of dropping out once you renew robotically.

You probably have a automobile insurance coverage coverage that’s due for renewal, keep away from taking the straightforward choice and rolling your contract over. As a substitute, use the Web to seek for provides. Many insurance coverage suppliers will save their greatest offers and incentives for brand new clients and it doesn’t all the time pay to be loyal. Should you discover cheaper automobile insurance coverage for a similar degree of canopy and you’re pleased with the service your supplier provides, contact them and see if they may match competitor costs.

In search of tailor-made provides

Most householders spend a considerable quantity of their month-to-month earnings on fuel, electrical energy and water. In case your utility payments are too excessive, it could be potential to avoid wasting by switching to a special tariff and searching for tailor-made provides.

If you’re on a default or customary cost, contact utility firms and be sure you are on the best tariff. There are a number of elements that may impression the suitability of a tariff, together with the variety of folks in your family, your common power consumption and once you have a tendency to make use of fuel and electrical energy.

Lowering power consumption

One other approach to decrease power payments is lowering power consumption. Many people are responsible of utilizing extra electrical energy or fuel than we have to. We depart the lights on after we depart the room and we go to mattress with out checking that each one our home equipment are switched off on the socket. If these eventualities sound acquainted, begin making a concerted effort to decrease power utilization.

Attempt to keep away from leaving home equipment on standby, maximize pure gentle and swap conventional bulbs for energy-efficient LED lights. Take brief showers, save water by turning the faucets off once you clear your tooth and wash the dishes, and accumulate rainwater in your backyard. You should utilize rainwater to water your crops and clear your automobile.

Should you don’t have already got a wise meter at residence, it’s an important thought to get one. Good meters monitor power utilization and expenditure in real-time. Together with your good meter, you possibly can scale back consumption and management spending to keep away from sudden payments.

Altering the place you store

All of us have days when we have to name at a retailer as a result of we’ve forgotten one thing or we fancy one thing particular to eat however comfort typically comes at a worth. Strive to consider the place you store and search for methods to cut back spending.

Going to fruit and vegetable stalls and markets, for instance, can typically be cheaper than visiting a grocery store however most of us are set in our methods and we go to the identical locations each week. Discover native companies, evaluate costs and plan a menu upfront.

Slicing down on non-essentials

There may be completely nothing flawed with treating your self however typically, we spend extra on non-essentials than we expect. You probably have a takeaway espresso each morning otherwise you purchase lunch from a deli or a restaurant day-after-day, you might save a fortune by making a drink at residence or on the workplace and getting ready your individual lunch.

Cooking at residence, creating packed lunches, taking a flask with you and reducing down on takeouts, eating out, shopping for garments and sweetness merchandise and organizing days and nights out can all increase your steadiness considerably. Use your finances to set a restrict for luxuries every month. It will allow you to steadiness saving with reaping the rewards of your onerous work. If you understand how a lot you must spend, you possibly can select easy methods to deal with your self with out feeling responsible.

Many people need to tighten our belts. It has been a difficult 12 months and for a lot of, it’s harder to steadiness the books. The excellent news is that there are a number of methods to decrease family prices, lower your expenses and trim bills with out overhauling your life-style or reducing out each single luxurious.

Begin budgeting now, analyze the place your cash goes, hold monitor of spending and all the time store round for the very best provides and offers. Keep away from lengthy contracts, seek for tailor-made provides and think twice about the place you store and what you purchase. Handle money owed and search recommendation should you’re struggling otherwise you’re not sure which money owed to attempt to repay first.