Making a monetary mistake can imply a serious catastrophe for you and your cash for years to come back, so it’s best to keep away from them if in any respect potential.

That being the case, beneath you can find among the most typical cash errors that would price you large in the event you make them, By understanding what they’re, you’ll be able to extra simply keep away from them and preserve your funds in fine condition.

1. Spending excessively

It’s apparent, however one of many greatest cash errors you can also make at any stage of your life is spending more cash than you actually need to on issues you don’t really want to pwn.

Sure, it may be good to deal with your self on occasion, and there may be nothing incorrect with doing so, however in the event you usually store ‘til you drop, you won’t be able to construct up a nest egg of financial savings and investments, and also you would possibly properly find yourself in debt.

Draw up a price range that’s wise and permits for the occasional deal with, and do your finest to stay to it.

2. By no means auditing your spending

On a associated word, one other actually frequent monetary mistake you can also make just isn’t usually taking rely of what you’re doing together with your cash.

Auditing your spending to see the place your cash goes; whether or not you’re losing money on subscriptions you by no means use; whether or not you may be spending much less on the utilities; whether or not you may truly be saving extra, gives you perception into the larger image and allow you to streamline your funds for better financial savings and extra future prosperity, ASuit each 6-12 months for finest outcomes.

3. Miscalculating your taxes

So many people mess up our tax returns, and never solely can it price us quite a lot of cash if we get it incorrect, but it surely may additionally get us in hassle with the regulation if it appears like now we have been hiding belongings or minimizing revenue.

That’s the reason it’s by no means a nasty thought to seek the advice of an expert like a crypto accountant to assist us with features of our accounts that we don’t perceive in addition to we possibly ought to. Sure, doing so will price us cash, however it’ll additionally save us cash and save us from the IRS, which suggests it’s a web acquire in the long run.

4. Shopping for new automobiles

Sure, that is actually frequent, and you probably have some huge cash to spare, it won’t be a mistake for you in any respect, however for the overwhelming majority of us, shopping for a brand-new automotive is like throwing cash down the drain.

New automobiles depreciate so quick that after getting pushed it off the court docket, it’s already a number of thousand {dollars} much less worthwhile than it was once you paid for it, and that makes it a poor monetary choice. Purchase used, and save that cash for one thing extra essential.

5. Not saving for retirement

As quickly as you begin working, it is best to begin setting apart a few of your wage for retirement. In the event you fail to put money into your retirement, then not solely will you must work for longer, however you would possibly discover that you just by no means construct up fairly sufficient of a nest egg to dwell comfortably when you do quit work.

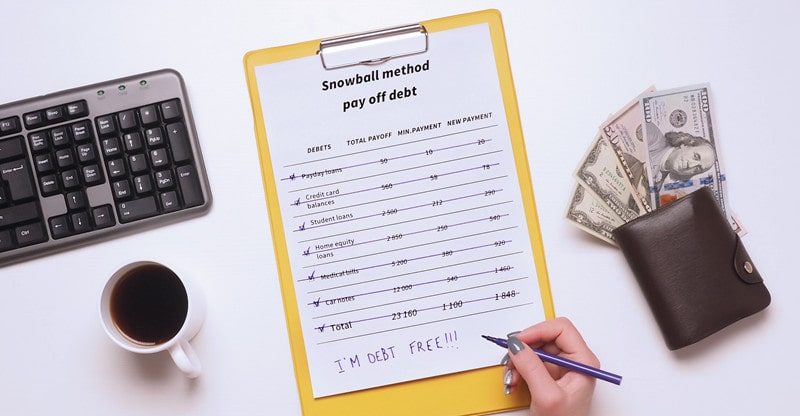

6. Saving when you have got money owed

Except you’ll be able to earn extra curiosity in your financial savings than you’re being charged by your bank card firms, then it virtually all the time makes higher monetary sense to repay money owed than it does to construct a nest egg. That being mentioned, it is best to attempt to put apart an emergency fund that equals a minimum of 6 months’ wage as quickly as you’ll be able to as this can assist see you thru any tough patches, so that’s the one main exception to the rule.

7. Not monetary planning

If you don’t plan in your monetary future, then you’ll now have any targets or goals and you’ll find yourself spending an excessive amount of, not investing sufficient, and customarily getting in a multitude together with your cash, Communicate to a monetary adviser and have them level you in the suitable route> make a plan, and comply with it as intently as you’ll be able to.

Cash errors can price you large, so no matter you do, do your finest to not make any of those errors when operating your monetary life, and in the event you aren’t certain what to do, take skilled recommendation!