Simply since you need to get your private funds so as doesn’t imply you’re closely in debt. It might simply be that you really want extra entry to cash and have the consolation of understanding that you’re not financially irresponsible.

Cash worries can have detrimental results on psychological well being and the higher form your funds are in, the higher your total psychological well being shall be. If that is one thing that you simply’re presently combating, the next are 5 methods to get your private funds so as.

1. Safe a Second Earnings

A second revenue will generate more money and in case you are attempting to turn into financially accountable, further money goes to make the method an entire lot simpler. There are lots of other ways you can begin gaining a aspect revenue, day buying and selling being one.

A easy method to make money within the brief time period, you’ll be able to match it round your current job. When you have no expertise in shares or day buying and selling, you need to perform a little research first. Check out a information for newcomers that may clarify all the pieces you want to know.

2. Finances

Take inventory of the place your cash goes. If you wish to take a trip however you’re struggling to search out the additional money to fund it, take a look at your finances and see the place there may be pointless spending. For those who’re spending more cash than you’re making, then you’re placing your self on the trail to debt, which has the potential to spiral right into a critical scenario. Finances correctly and totally.

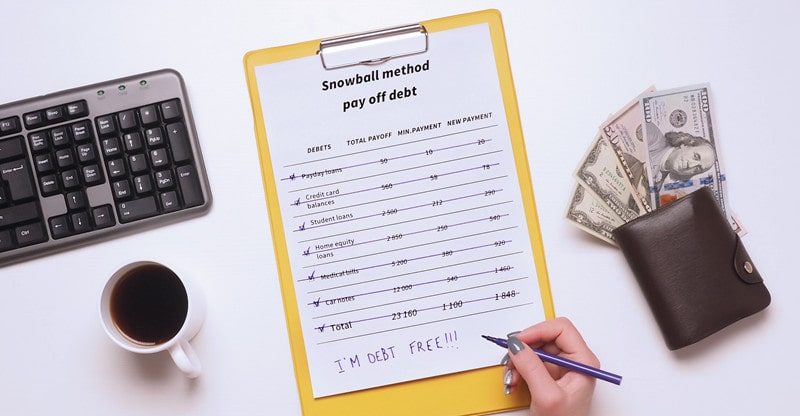

3. Pay Off Your Debt

It’s essential to know the ups and downs of debt and what’s categorised nearly as good debt, and dangerous. When you have debt then it’s going to be taking over a big a part of your revenue. The apparent answer is to eliminate it. That is simpler mentioned than finished however it isn’t not possible and can put you in a greater monetary place.

Think about consolidating your entire debt into one mortgage so that you’ve one simply manageable cost to make every month. This can make budgeting simpler. You may additionally be capable of come to higher phrases with lenders should you clarify to them your scenario. This can take strain off you and assist to enhance your monetary well being.

4. Save

In case your funds aren’t in nice form you’re in all probability questioning how one can save something in any respect. Use your finances to search out the place you’ll be able to reduce spending. Any further money you will have left over, put it right into a pot to maintain apart for a wet day or to save lots of up for one thing you actually need.

Doing this creates monetary self-discipline, one thing that’s important if you wish to get your funds so as. Use all instruments accessible to you so you’ll be able to hold monitor of each cent you personal.

5. Have a Lengthy-Time period Monetary Purpose

Create targets for your self. For those who really feel you’re setting cash apart for nothing, the temptation shall be there to spend it. What do you need to do along with your cash? Do you need to save up so you may get a mortgage on a brand new home? Or is it a a lot smaller aim resembling having the ability to take a trip twice a yr?

Set these targets in stone and you’ll then understand how a lot cash you want. Your monetary aim would possibly merely be to get out of debt, however understanding that and having it set as a aim will make it simpler to attain.